Everything You Need to Know About Car Insurance 2025

As we approach 2025, car insurance continues to evolve with technological advancements, changing regulations, and shifting consumer needs. Understanding the fundamentals of coverage options, cost factors, and comparison strategies will be essential for drivers looking to secure optimal protection while managing their budget effectively in the coming years.

Car insurance remains a critical financial safeguard for drivers, with significant developments expected in 2025. The landscape of coverage options, pricing models, and technological integration is undergoing substantial transformation. This comprehensive guide explores everything you need to know about car insurance in 2025, from basic coverage requirements to innovative policy features and cost-saving strategies.

Understanding Car Insurance Coverage Types in 2025

The foundation of car insurance in 2025 continues to build upon traditional coverage types while incorporating new elements. Liability coverage remains mandatory in most states, covering bodily injury and property damage you cause to others. Comprehensive and collision coverages protect your vehicle against theft, vandalism, weather damage, and accidents.

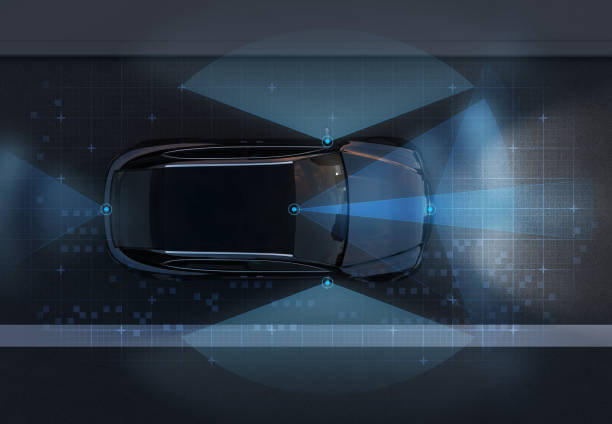

By 2025, many insurers are expected to offer expanded coverage options addressing emerging risks. These include specialized protection for advanced driver assistance systems (ADAS), electric vehicle components, and even coverage for autonomous driving features. Usage-based and pay-per-mile options are becoming increasingly standardized, allowing drivers to pay primarily for their actual road time rather than estimated usage.

Key Factors Affecting Car Insurance Costs in 2025

Car insurance pricing in 2025 reflects both traditional and evolving factors. Traditional elements like driving history, vehicle type, and location continue to influence premiums. However, insurers are increasingly incorporating sophisticated data analytics to refine their pricing models.

Telematics data plays a more significant role, with many insurers offering substantial discounts for safe driving behaviors tracked through smartphone apps or vehicle-installed devices. Credit scores remain relevant in most states, though regulatory changes in some regions have limited their impact. Vehicle safety ratings have gained importance, particularly those related to crash avoidance technologies and cybersecurity features for connected cars.

Environmental factors have also entered the equation, with some insurers offering lower rates for fuel-efficient or electric vehicles. Additionally, as climate-related events increase in frequency, location-based risk assessment has become more granular, affecting premiums based on specific neighborhood-level risk profiles.

How to Compare Car Insurance Policies Effectively

Comparing car insurance policies in 2025 requires attention to both coverage details and pricing structures. Digital comparison tools have evolved significantly, allowing consumers to evaluate policies based on personalized risk profiles and specific coverage needs. When comparing policies, focus on coverage limits, deductibles, exclusions, and additional benefits rather than just the bottom-line premium.

Many insurers now offer simulation tools that demonstrate how different coverage combinations would respond to various claim scenarios. This helps consumers understand the real-world implications of their coverage choices. Additionally, customer service ratings and claims satisfaction scores have become more transparent and accessible, providing valuable insight into the post-purchase experience.

Consider bundling opportunities with home, renters, or other insurance products, as multi-policy discounts remain significant. Also evaluate whether usage-based or mileage-based programs align with your driving patterns, as these can offer substantial savings for certain drivers.

Technological Innovations Shaping Car Insurance Prices

Technology continues to revolutionize how car insurance is priced and delivered in 2025. Advanced telematics systems now capture nuanced driving behaviors beyond speed and braking patterns, including distraction levels, contextual awareness, and even driver fatigue indicators through connected vehicle interfaces.

Artificial intelligence algorithms have enhanced risk assessment capabilities, allowing for more personalized pricing models. These systems analyze vast datasets to identify risk patterns that traditional actuarial methods might miss. For consumers, this means potentially lower premiums for those with safe driving habits, regardless of demographic factors that might have previously resulted in higher rates.

Blockchain technology has begun enabling smart contracts that automatically process claims and payments based on verified accident data, reducing fraud and administrative costs. Meanwhile, connected car technology provides real-time vehicle diagnostics and maintenance alerts that can help prevent accidents and subsequent claims, potentially earning policyholders additional discounts.

Car Insurance Provider Comparison for 2025

The car insurance market in 2025 features both established providers and innovative newcomers. Each offers distinct advantages in terms of coverage options, pricing models, and technological integration.

| Provider | Standard Premium Range | Key Features | Technology Integration |

|---|---|---|---|

| State Farm | $1,200-$1,800/year | Accident forgiveness, roadside assistance, drive safe & save program | Mobile app with virtual claims processing, telematics |

| Progressive | $1,100-$1,700/year | Name your price tool, snapshot program, small accident forgiveness | Real-time rate comparison, advanced telematics, usage-based options |

| Geico | $900-$1,500/year | DriveEasy program, mechanical breakdown coverage | AI-powered virtual assistant, automated claims processing |

| Allstate | $1,300-$1,900/year | Drivewise program, claim satisfaction guarantee | Predictive analytics for risk assessment, virtual reality claims inspection |

| Liberty Mutual | $1,250-$1,850/year | RightTrack program, lifetime repair guarantee | Blockchain-based claims processing, advanced driver monitoring |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

Strategies for Reducing Car Insurance Costs in 2025

Several effective strategies can help drivers minimize their car insurance expenses in 2025. Beyond traditional methods like maintaining a clean driving record and bundling policies, new approaches have emerged. Participation in telematics programs typically offers immediate discounts of 5-10% just for enrollment, with potential savings of up to 30-40% for consistently safe driving.

Vehicle technology discounts have expanded beyond anti-theft devices to include advanced driver assistance systems. Cars equipped with features like automatic emergency braking, lane departure warning, and adaptive cruise control often qualify for reduced premiums. Some insurers offer specialized discounts for vehicles with high cybersecurity ratings, recognizing the reduced risk of remote hacking.

Consider periodically shopping for new quotes, as pricing algorithms change frequently. Many insurers now offer loyalty price protection to prevent existing customers from paying more than new ones—ask specifically about this option. Finally, some insurers provide education-based discounts for completing defensive driving courses or specialized training for new vehicle technologies.

Conclusion

Car insurance in 2025 represents a blend of traditional protection principles and cutting-edge innovations. While coverage fundamentals remain important, technological advancements have created new opportunities for personalized policies, fairer pricing, and enhanced claims experiences. By understanding coverage options, comparing providers carefully, and leveraging available discounts, drivers can secure appropriate protection at reasonable costs. As the automotive landscape continues to evolve with autonomous features and alternative ownership models, car insurance will likely continue adapting to meet these changing needs.